-

Address: 421 Wando Park Blvd., Suite 100 Mount Pleasant, SC 29464

-

Phone: (843) 763-4200

-

Email: hello@mappusinsurance.com

Flood zones are more than just letters on a FEMA map—they’re critical factors in determining your risk, insurance eligibility, and premiums.

Why It Matters

Your flood zone classification affects whether you’re required to carry flood insurance, how much you’ll pay, and whether you need an elevation certificate to accurately assess your risk.

How It Impacts You

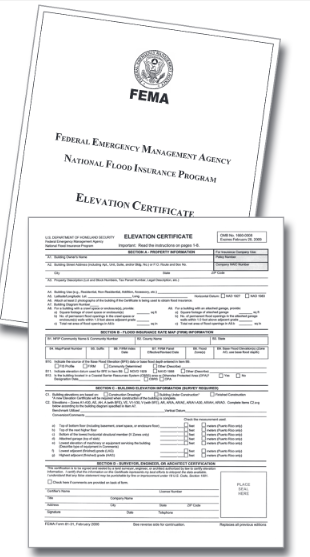

Homeowners in high-risk zones (like AE or VE) often pay significantly more for coverage. However, an elevation certificate can sometimes lower premiums if your property sits higher than base flood elevation. Without one, your insurer may assume worst-case scenario risk.

Be Proactive

Check your flood zone and determine whether an elevation certificate could save you money. These documents, prepared by licensed surveyors, provide precise data insurers use to set rates.

How Mappus (Afore) Helps

We help you obtain and evaluate elevation certificates and can quote multiple flood markets to find the best value for your coverage needs. We also educate you on mitigation options that may reduce your premium.

Flood zones change. Premiums change. Be informed. Let Mappus/Afore Insurance review your flood zone status and explore savings opportunities today.