-

Address: 421 Wando Park Blvd., Suite 100 Mount Pleasant, SC 29464

-

Phone: (843) 763-4200

-

Email: hello@mappusinsurance.com

Mitigation isn’t just about safety—it’s also about savings. Coastal homeowners who take proactive steps to reinforce their homes may benefit from lower insurance premiums and better storm protection.

Why It Matters

Insurance companies reward homes that are built or upgraded to withstand storm damage. From roof reinforcements to impact windows and flood vents, mitigation features reduce both risk and cost.

How It Impacts You

A properly mitigated home is more likely to survive a hurricane with less damage—meaning fewer claims, lower repair bills, and faster recovery. In Florida and South Carolina, wind mitigation credits can lead to substantial discounts on your homeowners insurance policy, which means more money in your bank account! The secret is, most insurance agents don’t talk about these discounts.

Be Proactive

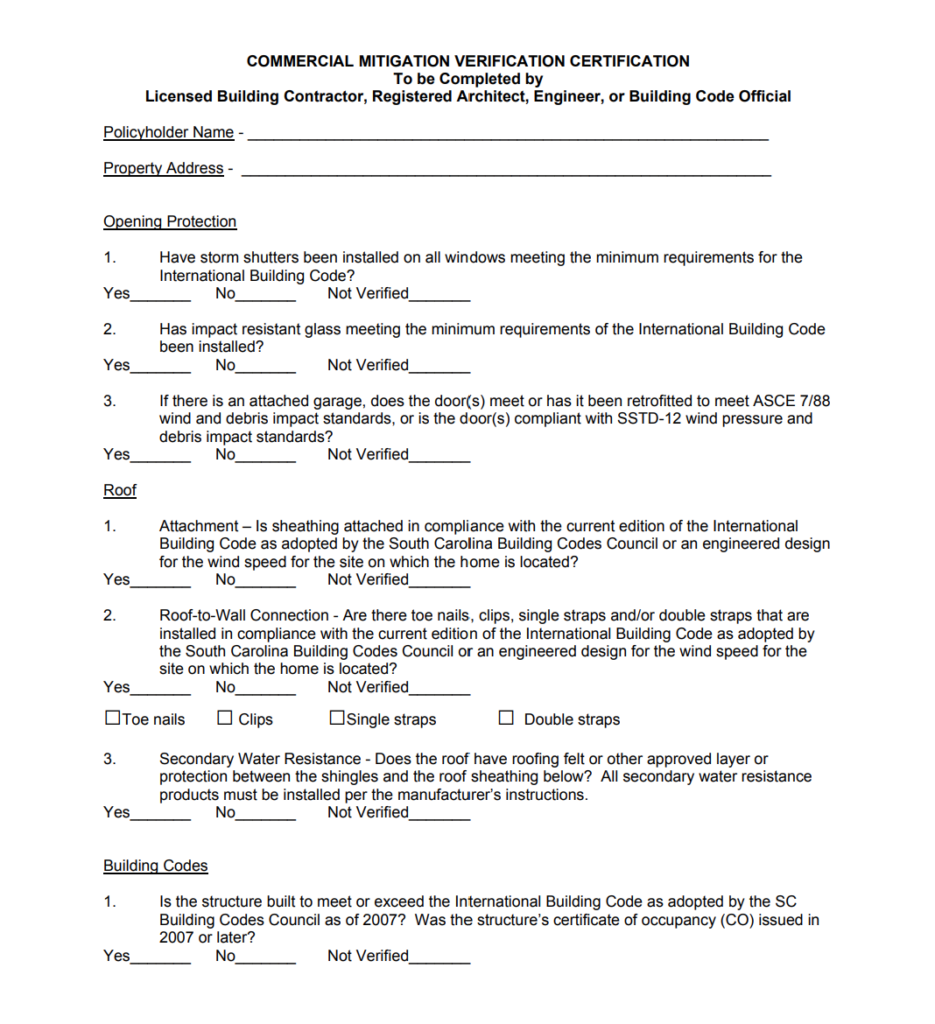

In order to receive these discounts, you need a wind mitigation form completed by a licensed contractor. Upgrades that may help include:

- Hurricane shutters or impact-rated glass

- Roof-to-wall connectors

- Secondary water barriers

- Reinforced garage doors

- Flood vents or raised foundations

How Mappus (Afore) Helps

We guide clients through the inspection and upgrade process and help apply any available discounts. Our knowledge of local building codes and insurance regulations ensures you get credit for every eligible improvement.

Don’t wait for a storm to test your home’s limits. Talk to Mappus/Afore Insurance today about mitigation options that can protect your property—and reduce your premiums.