-

Address: 421 Wando Park Blvd., Suite 100 Mount Pleasant, SC 29464

-

Phone: (843) 763-4200

-

Email: hello@mappusinsurance.com

Preventing Water Damage: The Strategic Role of Automatic Water Shutoff Valves in High-Net-Worth Insurance

Executive Summary

Water damage is one of the most common and costly claims in high-net-worth (HNW) home insurance. From burst pipes in winter homes to slow leaks in vacation properties, the financial and structural toll is significant. Automatic water shutoff valves offer a proactive and increasingly essential solution to mitigate these risks. This white paper explores how these devices reduce loss severity, enhance underwriting, and align with the evolving expectations of HNW clients.

Introduction

High-net-worth homes often include complex plumbing systems, premium finishes, and valuable art or collectibles—all of which are vulnerable to water damage. Given the rising frequency of claims and repair costs, insurers and brokers are turning to technology to mitigate risks before they become losses. Automatic water shutoff valves represent a simple yet transformative tool to protect homes, control insurance claims, and reduce premiums.

Water Damage: A Growing Threat

Water-related claims account for over 40% of all property losses in the high-net-worth segment, with average claim values often exceeding $100,000. Causes include burst pipes, appliance failures, HVAC leaks, and unattended incidents in secondary residences. Unlike fire or theft, water damage can be continuous and unnoticed for days or weeks.

– Aging infrastructure and materials in legacy estates

– Luxury features like radiant floors, wine cellars, and home theaters are especially sensitive to moisture

– Extended absences by homeowners increase risk of undetected leaks

The Case for Automatic Water Shutoff Valves

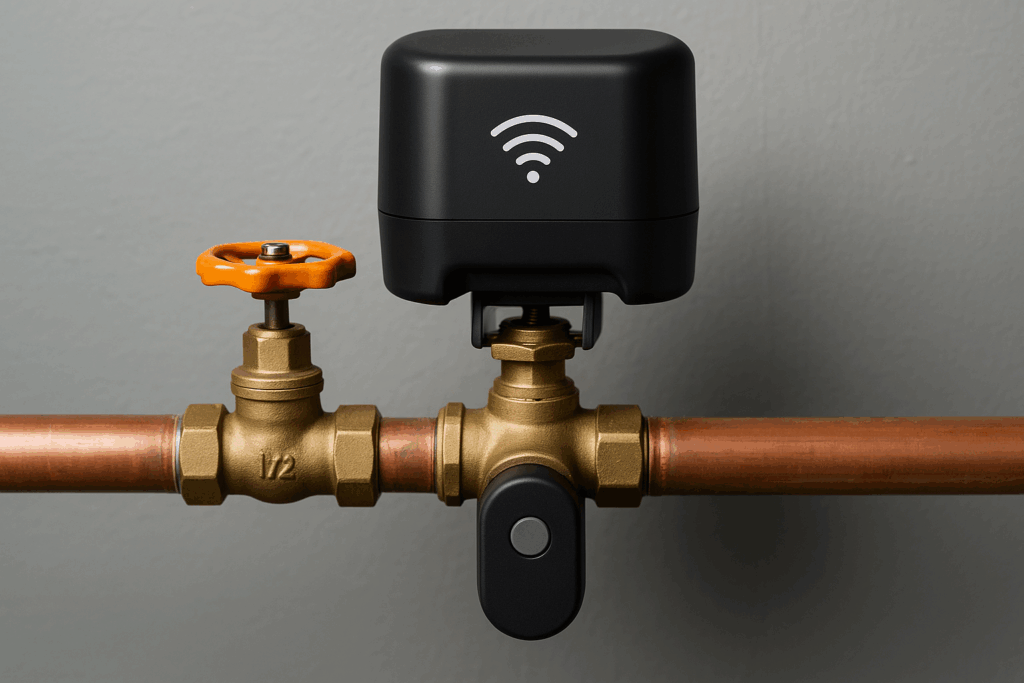

Automatic shutoff valves detect leaks or abnormal water flow and close the main water supply to prevent further damage. These systems use sensors, algorithms, or pressure monitoring to detect anomalies and act quickly—even when the homeowner is away.

Key Benefits:

– Immediate response to leaks, minimizing damage

– Remote access and control via smartphone apps

– Integration with smart home systems and alarm monitoring

– Valuable data for insurance underwriting and claims validation

Insurance Implications

Insurers increasingly view water shutoff systems as part of a layered risk mitigation approach. Some carriers offer premium discounts, preferred policy terms, or higher limits for homes equipped with certified shutoff systems.

– Lower claim frequency and severity improve portfolio performance

– Risk data from devices supports better underwriting decisions

– Compliance with underwriting guidelines for absentee owners or high-risk geographies

Recommended Systems and Features

– Flow-based detection (e.g., Flo by Moen, Phyn)

– Sensor-based systems for key locations (under sinks, near appliances)

– Wi-Fi or cellular connectivity with alerts and remote shutoff capabilities

– Professional installation and annual maintenance

– Battery backup in case of power outages

Implementation Best Practices

– Evaluate plumbing layout and risk zones

– Combine flow monitoring with localized leak sensors

– Ensure the main valve is accessible and compatible with automated devices

– Integrate with smart home controls for holistic protection

– Educate homeowners and property managers on system operation and alerts

The Future of Property Protection

As homes become more connected and insurers more data-driven, automatic shutoff valves will become a standard expectation rather than an optional upgrade. They not only reduce losses but also signal responsible ownership, improving trust between insurers and policyholders. For brokers and risk advisors, recommending these systems enhances client protection and policy value.

Conclusion

Automatic water shutoff valves offer a smart, strategic defense against one of the most persistent and costly threats to high-net-worth properties. By adopting these systems, homeowners can preserve their investments, reduce insurance costs, and gain peace of mind.

Reach out to Mark Gargula at Mappus/Afore Insurance to discuss your fine art insurance needs at 843.822.1612 or mark@mappusinsurance.com